Improving Efficiency and Equity with Geographically Targeted Gasoline Taxes

The negative effects of driving are concentrated geographically. The taxes should be too.

You aren’t just in congestion, you are congestion. When we drive, we incur private costs — we pay for gas, spend scarce time, and put wear and tear on our vehicles — but we also create costs for others. We slow down our fellow road users, becoming other people’s congestion. We also emit pollution, creating health and climate consequences, and increase the risk of vehicle collisions. Since we don’t pay for these costs, there is a gap between the total social and private costs of driving. Driving is therefore effectively underpriced, leading us as a society to drive more than we should.

Driving’s social costs vary widely from place to place. Adding a vehicle to the road in notoriously congested Manhattan, New York, can greatly exacerbate congestion costs, but adding the same vehicle to a road in Manhattan, Kansas, has a much smaller impact. Similarly, an additional ton of vehicular air pollution generally causes more harm in a densely populated urban area than a sparsely populated rural one.

Adding a vehicle to the road in notoriously congested Manhattan, New York, can greatly exacerbate congestion costs, but adding the same vehicle to a road in Manhattan, Kansas, has a much smaller impact.

There are policies that can reduce these costs. Taxes on gasoline, although designed primarily to raise revenue, also bring the social and private costs of driving closer together. For vehicles that use gasoline — still the vast majority of vehicles — gas taxes increase the costs of driving, and make drivers pay for at least a portion of the damage they impose on others. Drivers respond to these higher prices by driving less, reducing pollution and congestion. The level of the gas tax, however, varies much less by place than the damages from driving. The federal gas tax is the same regardless of where you are in the country, and California’s gas tax is the same in San Francisco as it is in Death Valley. That means the gas tax could be more or less effective from area to area.

Could a location-specific gasoline tax be more effective? In theory, allowing greater flexibility in gasoline taxes could better account for local differences in congestion and pollution costs, as well as local differences in the way drivers respond to higher prices. Targeting gasoline taxes to reflect local conditions may produce larger impacts on driving, provide greater societal benefits, and potentially increase political support for fuel taxes as citizens in heavily congested and polluted areas see the benefits of reductions in driving.

Measuring Differences in Driving Demand and Damages

Determining the effect of more targeted gasoline taxes requires a great deal of information about local travel behavior. Do drivers in rural and urban counties change their driving habits in response to higher or lower fuel prices in the same way? What effect does reducing vehicle travel on the roads of Manhattan, Kansas, have relative to Manhattan, New York? How much do environmental damages from local pollutants, like fine particulate matter or nitrogen oxide, vary across space?

The relationship between the demand for gasoline and the price of fuel makes the first question difficult to answer. In principle, a researcher could take advantage of the nation’s vast network of traffic sensors and measure how much the count of vehicles changes when fuel prices change. But the relationship between demand and prices runs both ways: increases in the price of fuel lead people to drive less, but changes in how much people drive change the price of fuel. An increase in driving can raise fuel consumption which can also cause prices to rise. As such, it can be difficult to determine the impact of increased fuel prices on driving.

The solution to this problem involves examining only those changes in gas prices that we know aren’t caused by changes in the demand for travel. I did this by looking at changes in gas prices caused by gasoline content regulations — the rules that govern the chemical composition of gasoline. These rules vary across places and the time of the year, with stricter regulations in place during the summer. These regulations change the price of fuel — because they change the costs of refining the fuel and limit what types of fuel can be sold in certain areas — but are not at all the result of changes in the demand for driving. Instead, they are what economists call a “price shock” — a change in price arising from outside the normal interplay of supply and demand. Examining the change in driving that occurs due to regulation-induced price shocks, then, gives us a better idea of how responsive drivers are to changing gas prices.

I combined data on these seasonal price shocks with over 770 million hourly observations from the network of traffic sensors in the U.S. between 2013 and 2016, and estimated how responsive drivers were to price changes. I separately estimated this responsiveness for 380 U.S. counties (about 12% of all counties nationwide), while also accounting for other factors, such as variations in driving caused by weather, economic conditions, the day of the week, and month of the year.

I found that, on average, traffic counts fall by 3.3% when gasoline prices increase by 10%. But a great deal of variation exists within that average, and the variation strongly correlates with urbanization. In more rural areas, like Elmira, New York (population 27,000), people do drive less when gas prices rise, but traffic counts fall much less than they do in the most urban areas, like New York City. On average, a 10% increase in gas prices leads to a 1% decrease in traffic counts in rural counties, but a 4% decrease in the most urbanized counties. This difference in response may arise because travelers in urban areas have more access to high-quality public transit and a built environment more amenable to walking or bicycling.

On average, traffic counts fall by 3.3% when gasoline prices increase by 10%. But a great deal of variation exists within that average, and the variation strongly correlates with urbanization.

Next, I estimated how changes in traffic counts affect travel speeds using the same count data as above, but now combined with information on trip travel times obtained from Google Maps. These highly detailed data allowed me to examine how congestion costs vary by location. Not surprisingly, adding a vehicle to the roads in the most urbanized areas reduces travel speeds five times more than adding one to a road in a small metropolitan area.

Finally, to calculate the damages caused by automobile pollution, I used estimates of average fuel economy and emissions per gallon of gasoline (from the U.S. Environmental Protection Agency) and estimates of per-ton emission costs at the county level that had been made by other researchers. These latter estimates cover a range of pollutants, including volatile organic compounds (VOCs), nitrogen oxides (NOx), fine particulate matter (PM2.5) and coarse particulate matter (PM10). Though there are exceptions, the environmental harm of driving a mile tends to increase with urbanization.

Comparing State- and County-level Gasoline Taxation

What do these geographic differences mean for gasoline taxes? Can we improve transportation and other outcomes by tailoring the gas tax to local conditions? For each of the 380 counties in my sample, I calculated the level of gas tax that would maximize consumer well-being, meaning the level that lets people maximize the private benefits of driving while also minimizing both the costs they themselves pay and the costs (in pollution and congestion) they impose on others. The model estimated these costs and benefits in dollars, and provided a final estimate of an overall improvement in consumer welfare, representing how much better off people in a county would be with a county-level gas tax than the state-level rate.

To keep the model simple, I make it revenue neutral. Although every county in a state will have its own gas tax, the county gas taxes, if added up, will raise the same total amount of revenue as the state taxes currently in place. The model, as a result, gives some counties a gas tax higher than the current state level and some a lower tax. I also account for some political realities. Gas taxes are unpopular, and it isn’t realistic to assume that voters would tolerate extremely high gas taxes, even in counties where conditions seem to justify them. In the model, I vary the maximum allowable tax increase in any county, to determine if welfare gains can be realized even with small increases in taxes.

I found that, when no limit is imposed on tax increases, county gas taxes have the potential to improve consumer welfare by up to $4.2 billion a year compared to the current uniform state gas taxes, while raising the same amount of revenue. Further, county taxes still yield a large social gain when I impose a limit on tax increases. Net efficiency gains of $754 million and $1.4 billion occur when I restrict the model to tax increases of $0.10 and $0.20 per gallon, respectively.

I found that the greatest benefits came from increasing taxes in the most urbanized counties. These counties are where drivers are more responsive to fuel costs and where the costs of pollution and congestion are highest. By increasing taxes in these areas, the model created substantial gains in consumer welfare. In contrast, the model — because it is revenue neutral — lowers taxes in more rural counties, often eliminating them. These tax decreases do lead to more driving, congestion, and pollution in those areas, but because drivers in these areas are less responsive to prices and have lower baseline levels of congestion and pollution, the net effect across all counties is an increase in welfare for consumers. If the model was not revenue neutral, gas taxes would have risen in every county, but the highest taxes would still be levied in the most urbanized counties.

County Gasoline Taxes and Equity

Since transportation makes up a larger share of expenditures for low-income households, increasing fuel taxes could disproportionately burden these households. Any proposal to increase gasoline taxes should consider how the policy affects people across different income groups.

Any proposal to increase gasoline taxes should consider how the policy affects people across different income groups.

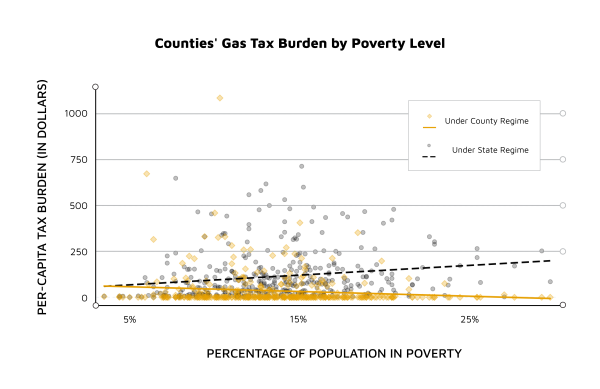

While a comprehensive equity comparison of the state and county taxation regimes would require driver income distributions, shares of household income spent on transportation, and other hard to obtain data, it is still possible to examine the broad consequences of varying gasoline taxes by county. Figure 1 shows how the total tax burdens in the county and statewide tax regimes vary with the share of the population in poverty in each county. The gray dots represent the percentage of the county population living in poverty and the per-capita tax burden from the current statewide gasoline tax. The orange diamonds represent the tax burden from the alternative county tax regime. Although there is substantial variation between individual counties, the upward sloping dashed gray line indicates that on average, counties with higher levels of poverty currently experience a greater tax burden per person, whereas under the county tax system, they would tend to have a lower tax burden (indicated by the downward sloping orange line). A 10% increase in the county poverty rate is associated with a $53.10 increase in the annual per-capita tax burden on average under the statewide gas tax, but the same 10% increase in poverty is correlated with a decrease in the annual per-capita tax burden of $36.70 under the county-level gas tax.

High levels of poverty in rural areas and differences in per-capita mileage drive much of the change in tax burdens across the regimes. The average change in tax burdens from the switch would be a reduction of $78 per capita annually, with some counties showing over $700 in per capita savings.

Figure 1. Tax burdens and poverty

Conclusions

Driving does more damage in some places than others, but we don’t currently tax gasoline in a way that captures this variation. My results suggest that fuel taxes should be highest in large metropolitan areas, as these areas see the bulk of the benefits from these policies in terms of reductions in pollution and congestion. Interestingly, some anecdotal evidence suggests that residents of large metropolitan areas find gasoline tax increases to be more palatable than rural drivers. For example, the “Yellow Vest” riots in France were largely conducted by rural residents to protest a proposed uniform fuel tax increase. Such evidence suggests that moving to a geographically variable gas tax regime could not only increase social welfare and improve equity, but would also make it politically easier for policymakers to raise gas taxes where doing so would deliver the most benefit.