Longer View: Positioning Transit for the 21st Century

Embracing new mobility technologies and models is essential to improving transit services

Traditional fixed-route, fixed-schedule public transit faces both challenges and opportunities from the latest wave of mobility services and new technologies. U.S. public transit ended 2018 with a fourth consecutive year of declining ridership. Multiple factors, including competition from Lyft and Uber, help explain the decline. However, public transit operators can incorporate the many information and communication technologies private mobility companies employ to improve service and reduce costs; and can partner with them to increase accessibility for many more travelers at a lower cost. But this will require technical innovations, improvements in public financing, and changes in transit priorities and management.

The long decline of public transit

Mass transit plays a valuable role in society. But more than a century of automobile use has contributed to sprawling urban development, undermining the efficacy and economics of bus and rail travel. Transit now accounts for about 2 percent of passenger trips in the United States and about 1 percent of passenger miles. The long-anticipated renaissance in public transit, supported by substantial public investment over the past five decades, remains elusive even as the country becomes more urban and populous.

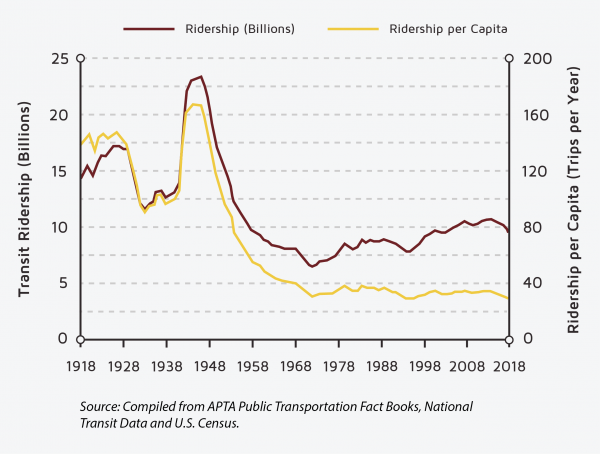

Ever since the first Ford Model T was introduced, U.S. public transit per capita patronage has faltered. The only exception was during World War II when gasoline was rationed and new cars unavailable. After the war, transit ridership fell from 114 trips per capita in 1950 to an all-time low of 30 in 1995, where it stands today (see Figure 1) — even as overall travel has continued to increase. Even transit’s mainstay, commuting in urban areas, dropped from 12.5 percent of all work trips in 1960 to 8.5 percent in 1970, 6.2 percent in 1980, and about 5 percent since 1990.

Figure 1. U.S. Transit Ridership Trends

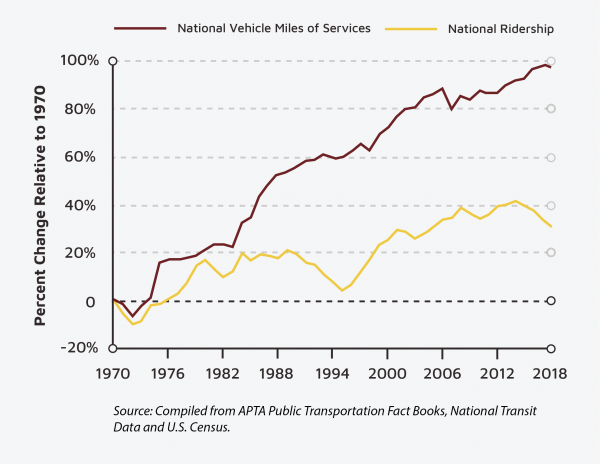

These losses have come despite growing transit investment. Total vehicle miles of transit service have grown dramatically, nearly doubling since 1970, while the change in ridership is less than half of that (see Figure 2).

Figure 2. Change in Ridership and Vehicle Miles of Service Relative to 1970

Today, the average operating cost of providing bus service — excluding capital costs — is well over $4 per trip. The cost of expanding service to attract more riders tends to be much higher, especially in suburban areas. Urban bus passengers in the United States pay only about 20 percent of the full operating and capital cost of service (rail riders pay 30 percent). The rest is covered by government subsidies. Total local, state, and federal subsidies doubled (controlling for inflation) between 1988 and 2010. Even so, transit agencies are challenged to ask for even higher subsidies in light of stagnant or falling ridership; the result is deferred maintenance, fare increases, service cuts, and underfunded pensions. These could commence a downward spiral in which lower productivity and lower fare revenues lead to service cuts that lead to even lower ridership.

Despite these struggles, public support for transit investment endures. Since 2000, voters in more than 200 American cities have voted to raise their own taxes to finance transportation improvements — usually including public transit — with an almost automatic presumption that “more” is better. Not only because more transit will serve disadvantaged travelers, but probably more so in the hope it will clear cars from the road, reduce traffic congestion, and garner environmental benefits. This broad political support has not, however, translated into higher ridership or greater efficiency and effectiveness.

Since 2000, voters in more than 200 American cities have voted to raise their own taxes to finance transportation improvements — usually including public transit — with an almost automatic presumption that “more” is better.

The challenge of change

To survive, public transportation will have to adapt to the boom in new services and technologies competing for customers — on-demand ride-hailing and van services (known as transportation network companies or TNCs), dockless scooters, and eventually, automated vehicles.

Studies indicate that Lyft and Uber are indeed undermining transit ridership, especially in dense cities, even though they are delivering some travelers to transit stations. The diversion in New York City and San Francisco appears to be substantial — with 10 to 30 percent of Lyft and Uber riders switching from transit. Should these services siphon off more and more influential higher-income customers, it could jeopardize political support for public transportation spending.

Still, the future of these new mobility services is increasingly clouded by slowing growth and problems with driver retention and compensation. Automation may change that and exacerbate the risks to transit. Shared automated cars and vans could provide quality mobility at reduced prices, possibly as low as (currently subsidized) transit fares, and especially in suburban and other markets where transit service is not time-competitive, routes are circuitous, or transit is not convenient or comfortable. Although the arrival of driverless vehicles is still years away due to technological and logistical issues, the start of real-world testing is adding color to visions of how vehicle automation and new mobility business models will influence travel behavior, the economy, environment, and other aspects of daily life.

Despite the uncertainty, moving forward is less risky than standing still. Until now, criticism of transit has been muted, even as subsidies have mounted and ridership has stagnated. Data on energy, cost, and environmental performance of public transit receive little attention, while proponents focus on other potential benefits, such as shaping land use, economic development, and urban livability. The primary reason, however, for the lack of attention is that until recently no good travel alternatives have existed. Now that new mobility services are rapidly emerging, criticism of transit may gain traction.

Meeting the challenge of the mobility revolution means re-envisioning transit for the 21st century. This will require integrating and leveraging these new technologies and developing new service models to reach markets currently not well served by traditional public transportation. Transit agencies may resist, but the cost of doing so could be marginalization and even extinction.

Integrating innovative technologies

While vehicle automation attracts the most attention these days, there are many other promising innovations — in-vehicle camera security systems, remote vehicle operation monitoring, various driver-assist technologies and safety systems, ride-hailing and customer service tools, and electrification — that could make transit more competitive.

Public transit can benefit from web- and mobile-based apps to give travelers convenient access to information about travel options, as well as real-time updates and convenient fare payment to help them plan trips using different modes, even in unfamiliar places. For example, OneBusAway is an open-source platform for real-time transit information developed by the University of Washington and currently available in cities across the globe. RideTap software from Moovel makes it easier for transit agencies to integrate their services with other shared mobility providers. The Dallas Area Rapid Transit GoPass app helps riders plan and pay for “complete trips” using Uber to access DART.

Ride-hailing tools can also improve paratransit, the specialized transportation services for travelers with disabilities, by helping to coordinate service across more providers and agencies with vehicles capable of handling wheelchairs and mobility aids.

The use of electric buses is on the rise, especially in China, which has 421,000 in operation, but also increasingly in the United States. Some cities, led by Shenzhen (with a population of more than 15 million) have converted every bus to battery-electric propulsion. California has followed suit, mandating in late 2018 that all transit buses in the state operate on electricity by 2040 (meaning essentially all new bus purchases must be electric by 2028). Many other American cities from Seattle to Tallahassee, Florida, are accelerating their purchases of electric buses, encouraged by dramatic improvements in battery cost and capability.

But the most tantalizing opportunity to increase transit’s competitiveness is automation, in part because of the high cost of employing bus operators. Information drawn from the National Transit Database indicates that bus operators account for 42 percent of bus operating expenses. Automating transit buses and vans will mean a massive restructuring of public transportation services, but companies already have well-established operational protocols and insurance, high vehicle-utilization enabling the rapid accumulation of service time, professional maintenance staff, high public exposure, and established fleet facilities, all of which can facilitate the transition. Also, they operate on fixed routes, providing a defined physical environment for autonomous operation. Instead of running a few large buses (to lower labor costs by carrying more passengers per vehicle) transit agencies could run smaller driverless vehicles at higher frequencies and thereby provide more frequent, less crowded service. All these factors make buses an attractive laboratory for an early application of safety-enhancing, cost-reducing vehicle automation technologies. The potential to improve performance and safety help justify the policy, investment, and regulatory changes needed to deploy these new technologies broadly.

Multiple factors make buses an attractive laboratory for an early application of safety-enhancing, cost-reducing vehicle automation technologies.

Automation also provides an opportunity to reduce costly investments in expanded rights-of-way for exclusive lanes for bus rapid transit and grade-separated rail lines that restrict high-speed transit to a limited number of high-volume locations. In a fully automated and managed transportation network, with computers and sensors guiding vehicles, public transit could travel along congestion-free lanes without requiring expensive new infrastructure.

New service models to bolster transit

Ultimately, shared-ride vehicle services, automated or not, can reach far-flung people and places, transport persons with disabilities, plug first/last-mile gaps, and feed into public transport operating along major corridors. Transit agencies around the globe are already launching demonstration and pilot projects, including partnerships with Lyft and Uber, real-time rideshare-matching services, short-term car and scooter rental, and bikeshare services. Several transit agencies in the United States and Canada are subsidizing TNCs or microtransit providers in less dense, suburban areas where traditional transit service is especially expensive.

Pilot projects provide experiences that can lead to planning better public transit connections and services. Of particular interest is how first/last-mile services can increase ridership for fixed-route services. Ultimately, transportation providers will need to understand how the cost, performance, and environmental impacts of investing in complementary services compare to such traditional ridership-enhancing strategies as reduced fares, park-and-ride lots, increased frequency, more routes, and expanded hours of operation.

Going forward, the transit industry — and local leaders — will have to assess the ability of ride-hailing and other new mobility companies to be good partners and to provide reliable service, adequate capacity, and stable pricing. Among the many questions is their ability to scale up, given the limited number of drivers available at the low compensation levels now offered.

While the case for new transit partnerships and a new vision for public transportation is compelling, and the opportunities they present are enticing, they are also fraught with political land mines. Transit services employ union labor, offer low fares to serve low-income riders, and often extend routes into low-density suburbs, at high cost, to better serve the community. Changing these practices would inevitably affect their stakeholders. If they reduce or withdraw service, or partner with non-union private entities, they become vulnerable to political backlash that could further threaten the support public transit currently enjoys.

Helping public transportation flourish

Public transportation is on the cusp of dramatic change. New transformational technologies and service models are already having profound effects on transit. Current methods of delivering and managing transit must change if the mode is to remain viable. More traveler choice and better service are possible, but by no means assured. A multiplicity of stakeholders, limited funding streams, the needs of carless travelers, and the economic vitality and livability of cities frame these challenges.

Policy will play a crucial role in shaping the future of public transportation if the path forward is not left solely to the pace of technological evolution and market forces. Some things are clear. First, financial support must be adequate to sustain transit infrastructure and services in high-volume locations where large vehicles and trains are uniquely suited.

Second, the government must provide a social safety net of affordable mobility for low-income urban travelers and ensure door-to-door assisted services for travelers with mobility limitations. Alternative mobility options that undermine these obligations should be eschewed; those that can better serve riders with disabilities at less cost should be pursued.

Third, as private companies begin to play a larger role, local government oversight will be needed to ensure equitable access for all and to protect the public from abusive practices all the while without stifling innovation or hindering private sector competition.

Fourth, transit policymakers will have to address the labor implications of automation on the 200,000 bus-operating employees for fixed-route services and 100,000 employees for demand-responsive services. Managing fare collection, monitoring customer behavior, and providing customer information without an onboard operator will surely prove a challenge for public transportation going forward.

Fifth, one of the most critical issues facing transit stakeholders is long-range planning and capital investment decision-making, in light of the long lifespan and high cost of many fixed-infrastructure commitments. For example, today’s new rail projects might come on line just when new automated vehicles appear, cutting into anticipated business. New mobility options could also influence urban development patterns, further altering travel demand. Meeting these challenges in a responsible fashion will be key to retaining credibility with the public.

The future of transportation is highly uncertain. What is certain is that travelers will have more choices from an array of new mobility options varying in cost, speed, convenience, flexibility, safety, reliability, comfort, and environmental impact. The path forward requires tearing down silos among transport modes, perhaps more quickly and deliberately than ever before. Affected groups — users, local governments, taxpayers, operators, advocates — need to begin organizing around the mobility needs of various market segments and quality-of-life objectives, rather than around existing modes, technologies, or governance structures. Progress will require leveraging the entrepreneurial private sector in such a way that it can complement the purposes that have sustained the historic public investment in transit.