The Necessity of Cars

America is built for driving. We should change that, but in the meantime we should help low-income people drive.

In a classic essay, the late Berkeley planning professor Melvin Webber observed that automobiles have “network externalities” — their usefulness to any one person depends on how many other people have them. Telephones are a good example of network externalities. When just one person has a phone, it’s useless. When everyone has one, it’s a revolution.

Cars are a little more complicated. A world with one car doesn’t make that car useless, but does make it less useful, because a one-car world will lack much of the supporting infrastructure cars need — wide paved roads, abundant parking spaces, and easy access to gas stations and mechanics. When most people have cars, in contrast, this infrastructure becomes commonplace, and driving gets easier.

Network externalities cut two ways, however. As society becomes more organized around vehicles, people without vehicles risk being left out of society. This exclusion occurs not just because people with cars can get around more easily than people without them, but because the physical changes that let cars move quickly also disadvantage other forms of mobility. Cars thrive in environments where densities are low, streets are wide, blocks are long, and parking is ubiquitous. These same attributes, by pushing destinations apart and enabling high speeds, make transit less effective, and make walking and cycling less feasible and less safe.

This logic yields a prediction: Over time, as driving becomes more common, it will also become more necessary, and anyone who can acquire a vehicle will do so, even if doing so is financially burdensome. People without vehicles, as a result, will become increasingly disadvantaged, because only the most disadvantaged people will be without cars.

Some simple evidence from the U.S. Census is consistent with this prediction. Between 1960 and 2014, the U.S. poverty rate fell from 24% to 14%. For households without vehicles, however, the poverty rate rose slightly, from 42% to 44%. This increase occurred, moreover, as vehicle access among poor households increased sharply. In 1960, just under 60% of poor households owned a car, compared to just over 80% in 2014.

That basic idea — that more poor people will acquire automobiles even as more people without automobiles will be poor — is what motivates this article. Our research examined this changing nature of carlessness, and what might be driving it. Our findings suggest that we have created a world that often demands a car, and that even as automobiles have become more necessary, they have not become less expensive. There are different ways to address this problem. In the long term we should want a world more hospitable to other ways of moving around. In the short term, however, we should strive for universal auto access: helping low-income people get and keep cars.

Few inventions changed the American landscape more than the automobile, and many changes that made driving easier also made not driving harder.

The Declining Fortunes of Carless Households

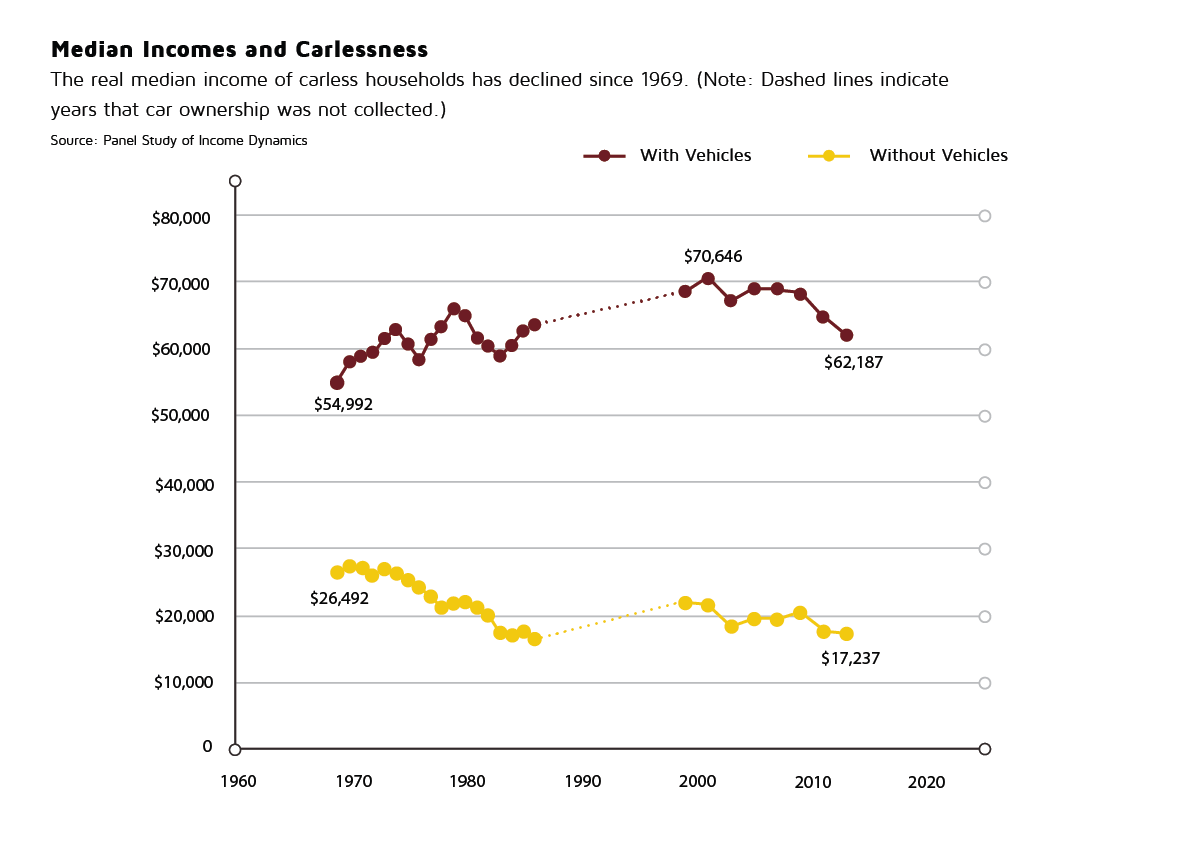

Figure 1 uses the Panel Study of Income Dynamics to examine the income of families with and without cars between 1969 and 2013. The real (inflation-adjusted) median income of families with cars rose 20% during this time, from $55,000 to $62,000, while the income of families without automobiles fell 34%, from $26,000 to $17,000. This finding is notable. Income gaps in the postwar U.S. have widened along many dimensions, but usually because one group is increasing their earnings faster than another, not because one group is losing ground absolutely. Overall U.S. income inequality, for example, has risen because the richest households have added to their income faster than the poorest households. But the poorest households have seen their incomes grow. Low-income households today have higher incomes than low-income households 50 years ago.

This is not the case with motor vehicles. Households without vehicles in 2013 earned less money, in absolute, inflation-adjusted terms, than households without vehicles in 1969. A vehicle, in this way, is analogous to a college degree. Over time, college degrees have become more valuable, and the fortunes of people without them have fallen. But even that comparison isn’t strong enough. Real average earnings for people without college degrees have stagnated, but they haven’t gone backward. Carlessness, in contrast, is associated with actually losing ground, making the economic penalty associated with it more distinctive.

One result is that in the postwar 20th century, carlessness became increasingly concentrated at the bottom of the income distribution. In 1955, more than 90% of the top-earning households had automobiles, as did 75% of households in the middle class. Only one-quarter of bottom-decile households, in contrast, did. In the decades that followed the middle class converged with the top, making vehicle ownership almost universal among households that were not disadvantaged. Carlessness also fell in the bottom decile, but by 2013, almost half of these lowest-income households were still without vehicles.

This process yielded the pattern we mentioned in the introduction: Low-income households became more likely to have cars, but households without cars became more likely to be low income. In 1955, a great majority of the nation’s poorest households lacked a car. Because carlessness was still relatively common, however, these households accounted for only 25% of the carless households in the U.S. By 2013, in contrast, only 45% of bottom-decile households lacked an automobile. But this small group — less than 5% of U.S. households — accounted for 41% of American carlessness. Carlessness had become a reliable marker of disadvantage.

The Network Externality

What caused the fortunes of carless households to fall? The causal relationship between vehicle ownership and income is two-directional. People might have low incomes because they lack cars (cars help people find and keep work). But people might also lack cars because they have low incomes (cars are expensive). If we see the income gap between people with and without cars expanding, then one explanation is that cars have become more expensive.

Did this happen? Automobiles are without question a better deal today than they were decades ago. For a given dollar spent, we now get bigger, safer, more comfortable, more reliable, and better-performing cars. So the “quality-adjusted” price of cars has plummeted. In real terms, however, the amount of money we hand over to get a vehicle has changed surprisingly little, whether measured absolutely or as a share of typical household expenditures. From 1967 to 2014, for example, the average selling price of a vehicle (in real dollars) rose from just above $23,000 to $26,000. During that time, real median household incomes grew from just below $51,000 to just above $52,000. Car prices, therefore, probably don’t explain the falling incomes of carless households.

That brings us to a second explanation: the network externality. This explanation posits that the automobile’s role in socioeconomic status has grown because society has become more oriented around cars, making cars more essential to getting and keeping work.

We tested this idea by examining a place not organized around cars — New York City — to see if it has the same relationship between vehicle ownership and income that we see elsewhere. New York is America’s largest city, and while the sticker price of a car in New York is not much different from other American cities, the built environment is very different. Of all U.S. cities, New York has changed least to accommodate the automobile. New York stayed dense even when its population was falling, and today it is bigger and denser than ever. Its streets remain mostly narrow and organized in short blocks. Off-street parking is scarce and expensive. Gas stations, especially in Manhattan, are hard to find. New York, in short, has long been a difficult place —for reasons other than car prices — to own and operate a vehicle. It should also, given our logic, be a place where households without automobiles have fared better.

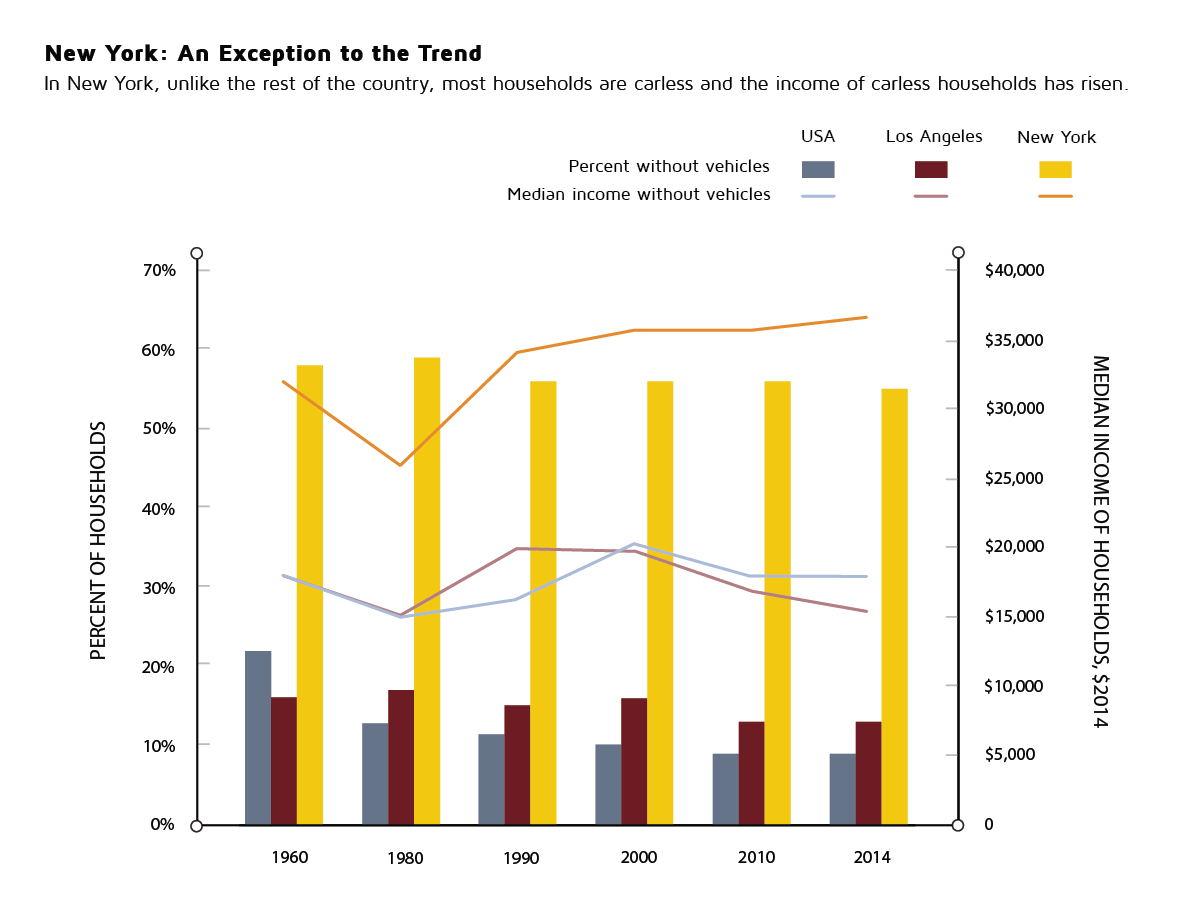

Figure 2

That turns out to be the case. Figure 2 uses census data from 1960 to 2014 to compare New York to Los Angeles (the country’s second-largest city) and to the U.S. overall. The figure shows, first (in vertical bars), that in every decade since 1960, most New York households have been vehicle-free. In Los Angeles and the nation overall, in contrast, carlessness has been rare and getting rarer. The figure also shows (in horizontal lines) that the economic fortunes of New York’s carless population differ dramatically from those of carless households in Los Angeles and the U.S. Since 1960, the median income of zero-vehicle households in Los Angeles fell 14%. In New York, the median income of carless households rose, and by 2014 it was more than double that of carless households in Los Angeles ($36,600 vs. $15,400).

Comparing carless households in New York and the U.S. yields a less dramatic result — the incomes of the American carless fell only 1% — but that number is a little deceptive. Between 1960 and 2014, the nation’s carless households, particularly those who weren’t poor, became increasingly concentrated in New York. Outside New York, the median income of American households without cars fell 17% between 1960 and 2014, a decline even larger than the one in Los Angeles.

These data are consistent with the idea that carlessness imposes less of an economic penalty in places that aren’t organized around automobiles. To be clear, though, these data do not suggest that no income gap exists between New York’s households with and without cars, or that vehicle ownership in New York is uncorrelated with income. On the contrary, this correlation exists, and is every bit as strong as it is in Los Angeles. The key distinction is that in New York, the correlation arises because people with cars are likely to be rich, not because people without cars are likely to be poor. Low-income households in New York, compared to those in Los Angeles or the nation overall, are actually more likely to be carless (again, car ownership in New York is expensive). But so too are middle- and even high-income households. As such, it is less the case that lacking a vehicle in New York is a reliable marker of low incomes, and more the case that owning one is a reliable marker of high incomes.

One could reasonably object to these comparisons by noting that New York differs from Los Angeles, and the U.S. overall, in many ways beyond the auto-centrism of its built environment: It has different governance, climate, and labor market conditions. Any of these, and not the built environment, might influence the incomes of its residents without cars.

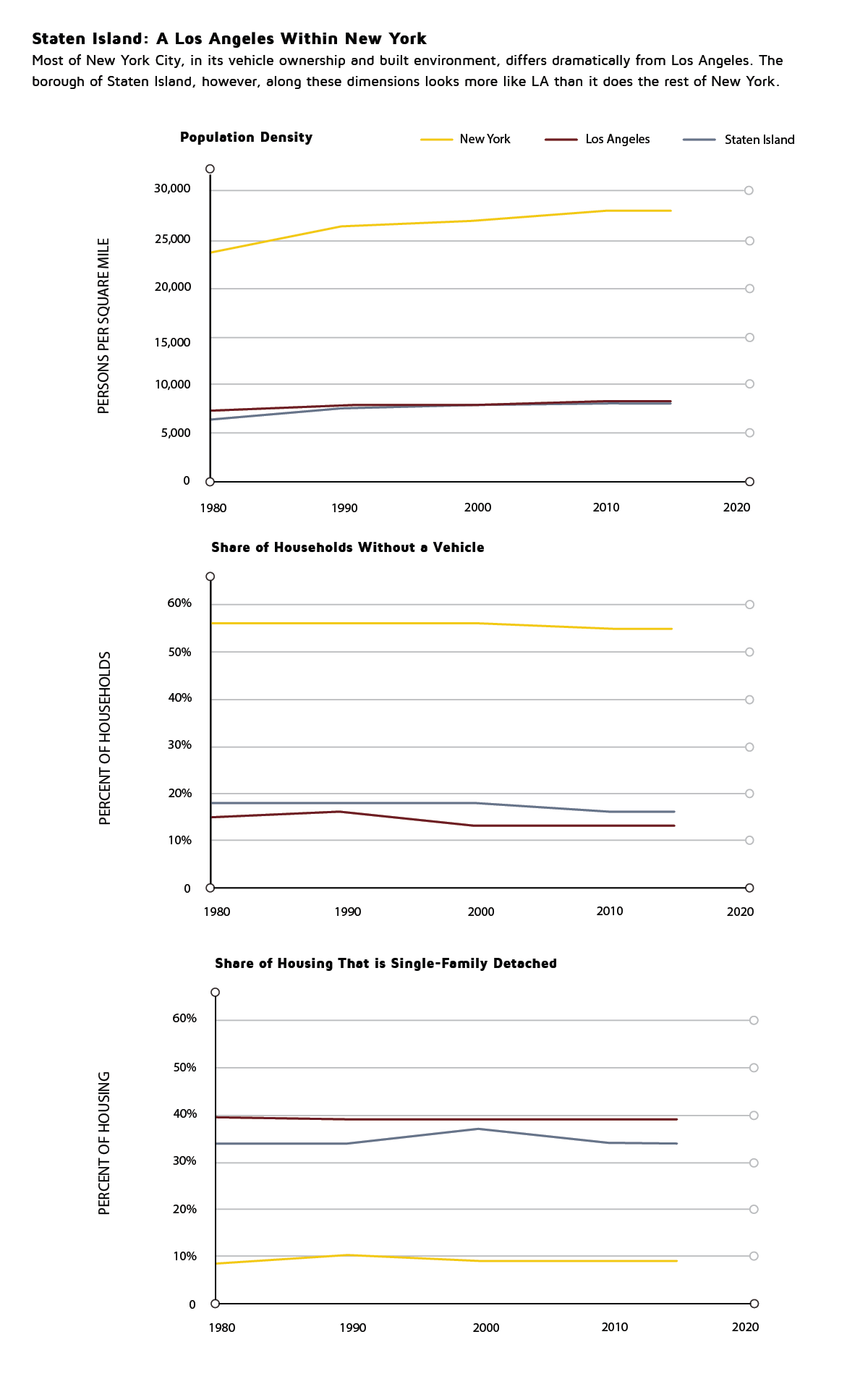

We address this concern by making an additional comparison within New York, using the borough of Staten Island. Staten Island has the highest median income of all New York boroughs, and it shares a government, climate, and labor market with the rest of the city. But it has a far more auto-oriented built environment. Staten Island lacks subway connections, has more off-street parking, and has many more single-family homes. Indeed, as Figure 3 shows, Staten Island — in its density, car ownership, and housing stock — has long looked more like Los Angeles than like the rest of New York.

Figure 3

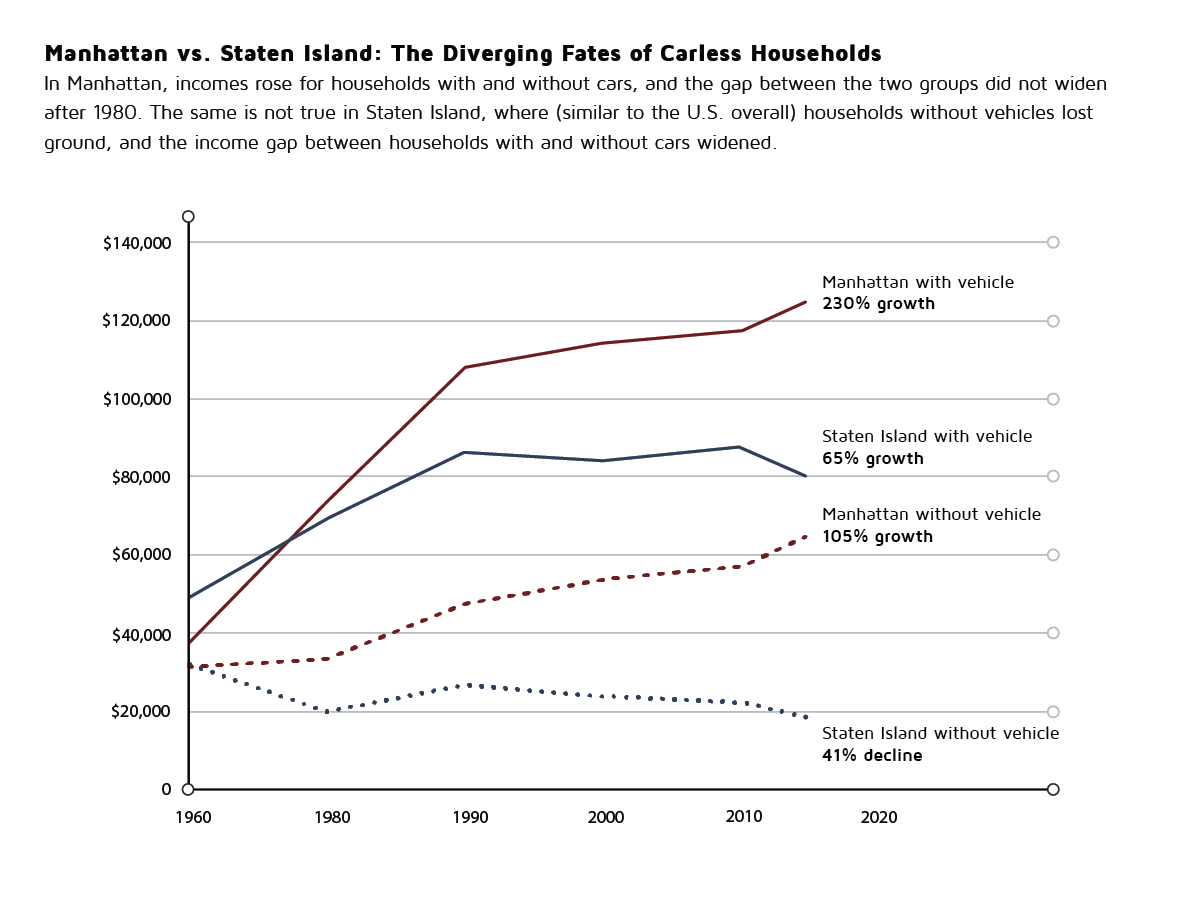

If our logic holds, the fortunes of the carless on Staten Island should have declined more dramatically than those in New York overall, even though Staten Island is more prosperous. Figure 4 compares Staten Island to Manhattan, the borough that is both closest to Staten Island in income and least hospitable to automobiles. Recall from Figure 2 that in New York overall, the median income of carless households grew 12% from 1960 to 2014. In Manhattan, the median income of carless households more than doubled. This growth was slower than the income growth of Manhattan households with automobiles (which more than tripled), but the income of zero-vehicle households nevertheless grew, and since 1980 their income growth has kept pace with the income growth of Manhattan households with cars, meaning carless households did not lose ground relatively.

Figure 4

The story is different on Staten Island. There, median income grew 65% for households with vehicles, but fell 41% for households without. In 1960, Staten Island households with vehicles had, on average, 1.5 times the median income of carless households. By 2014, they had more than four times the median income of carless households. And while these comparisons are admittedly simple, when we run statistical tests that control for many other factors, the basic result holds. On Staten Island, unlike in Manhattan or New York overall — but similar to Los Angeles and the rest of the country — the fortunes of carless people fell both relatively and absolutely.

Toward Universal Auto Access

Few inventions changed the American landscape more than the automobile, and many changes that made driving easier also made not driving harder. In most of the country, as a result, cars have become a necessity, and while cars have improved dramatically, they have not become much more affordable. Households that cannot afford cars have lost ground.

One obvious solution is to create more places like New York, where automobiles aren’t essential for economic success. This goal is undeniably important, but the built environment changes slowly, so it is also indisputably long term. Pursuing changes to the built form of cities offers little help to the many low-income households suffering from restricted mobility today. In the short term, the best approach is to help low-income people get and keep cars.

That idea might sound strange, particularly from three urban planners who are not generally boosters of the automobile. But it is realistic. The United States has constructed a vast and comprehensive public infrastructure that requires most people to drive most places. Every year, close to one in 10 households cannot afford the private investment (a car) necessary to access that public infrastructure, and as a consequence they cannot fully participate in our society and economy. We should change the public infrastructure, but it is faster and easier, in the meantime, to help low-income people with the private investment.

There is precedent for this approach. Automobiles arrived as part of a larger wave of infrastructure innovation — indoor plumbing, electrification, refrigeration — that profoundly changed America. Like automobiles, these other innovations were initially rare and adopted by the rich. Unlike automobiles, these other innovations became truly universal. Virtually no households today lack electricity, refrigeration or indoor plumbing, and every state has programs to help low-income people maintain access to these essential services. The same isn’t true of automobiles. Almost all U.S. adults who can drive have a car, and because of that, people who lack cars suffer. But the minority of Americans who can’t afford cars are rarely offered help getting them. Instead they are offered public transportation, which in most places is a poor substitute for driving. Making transit better is a worthy goal, but it should not prevent us from helping low-income people drive.

One objection to expanded auto access is that low-income people are a large and disproportionate share of transit riders; helping them get cars could further undermine transit, at a moment when transit is particularly vulnerable. But low-income people do not owe society a viable transit system. If a car is the best way for many low-income people to get around (just as it is for many high-income people), we should not begrudge low-income people the decision to drive.

A different objection is that driving has serious social costs — from carbon emissions, pollution, congestion, and crashes — so we should promote less rather than more of it. Consistency matters, however: if we use this logic to deny low-income people assistance in getting cars, we should also deny them assistance in getting electricity or heating fuel. Burning fossil fuels to heat and power households, after all, has negative consequences that rival those from cars. We don’t, of course, deny heat and power to poor households in the name of sustainability. We understand, in these arenas, that our sustainability goals hinge on reduced consumption by the majority of people who aren’t poor. Our (sensible) approach is to help low-income people keep basic access to electricity and heating fuel, even as we use pricing (through meters) to minimize overall consumption.

We could do the same with automobility, but currently we do the opposite. We offer no assistance with basic access, but heavily subsidize use for those affluent enough to gain access on their own: Once you have a car, the roads are free and the parking is abundant and cheap. As a result, we have a small group of people who need vehicles and lack them, and a large group who have vehicles and use them needlessly. A just and sustainable society would help the former drive more while nudging the latter to drive less. Instead we discourage driving only by withholding it from the small group of people who would benefit from it most. This approach is neither fair nor effective; the costs it imposes are large, and the benefits it delivers small. It doesn’t reduce driving enough to help the environment, but denies low-income people increases in mobility that could be life-changing. The evidence is clear: Policymakers concerned about access to opportunity should consider subsidizing low-income car ownership.