Going My Way? The Evolution of Shared Ride and Pooling Services

The rise of pooling has reshaped how we get around — and who we travel with

Sharing rides is a longstanding tradition that predates even horse-and-buggy travel. Recent innovations, however, make sharing a ride easier, more convenient, and more efficient. Innovative mobility services premised on pooling — getting multiple riders into the same vehicle — can lower travel costs, mitigate congestion, and reduce greenhouse gas emissions. They also offer travelers more mobility choices between the traditional bookends of auto ownership and public transit.

The motivations for pooling are simple. There are economic incentives. Cars are among the most underused capital assets in our economy, sitting empty 95 percent of the time and usually carrying only one person the rest of the time. If cars were used more often, and if they carried two, three, or four passengers, their cost per rider, and per hour, would drop dramatically. But the benefits of pooling go well beyond cheaper mobility. If the car is carrying many people who might otherwise drive themselves, sharing can result in fewer vehicles on the road, which means less air pollution and energy use and fewer greenhouse gas (GHG) emissions and parking spaces. With more than 1 billion cars and light trucks in the world, the potential for major reductions in pollution and GHGs is huge — in the United States and most other countries.

We know that technologically, a future with many shared rides is now possible. What we don’t know is whether and under what conditions people will be willing to make that transition. Thinking about this possibility requires that we understand the history of shared mobility, and how it interacts with modes we already know.

We know that technologically, a future with many shared rides is now possible. What we don’t know is whether and under what conditions people will be willing to make that transition.

Historic Trends, About to Be Disrupted

Shared mobility is a radical departure from the culture of auto ownership that has long dominated the industrialized world. This culture became entrenched after World War II, when interstates, suburbs, and auto-oriented industries (such as drive-thru restaurants) grew. Almost everywhere, car ownership increased and public transit use often declined — despite efforts to boost its ridership. The affluent world, to a greater extent, was defined, by driving alone.

Efforts to change this situation have for decades met little success. Since the late 1960s, public agencies, particularly in the United States and Canada, have tried to increase the use of carpooling and vanpooling. They have enacted trip-reduction ordinances to discourage solo driving, built carpool lanes and park-and-ride lots to make sharing easier, and used telephone and computerized ridematching to help people interested in carpooling find each other.

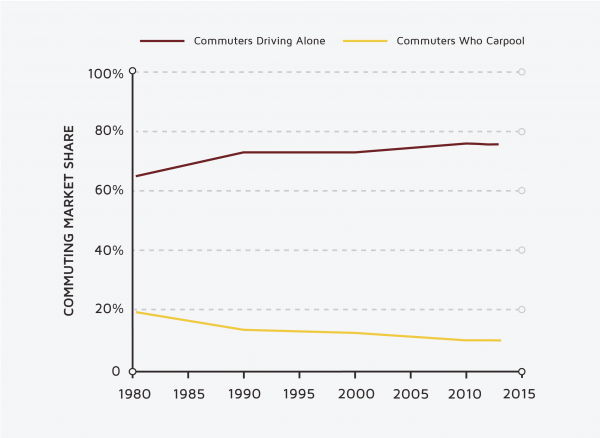

In the United States, these efforts saw modest success during the energy crisis of the 1970s — with carpooling’s commute share peaking in 1980 at 20.4 percent. From there, carpooling’s commute share dropped steadily and was only 9.4 percent by 2013 (see Figure 1). Over the past decade, advancements in technology, such as smartphone apps, enable people to arrange shared rides in a variety of ways.

Figure 1. The decline in carpooling and the growth in commuters driving alone in the United States

The Rise and Repercussions of TNCs

For-hire ride services, such as transportation network companies (TNCs), differ from traditional ridesharing, as they provide travelers with pre-arranged and on-demand access to transportation services and do so for a fee. The service runs via digital applications by connecting customers with drivers — who either use their privately owned vehicles or one from a maintained vehicle fleet. Common service providers include Lyft, Uber, Ola Cabs in India, Grab in Southeast Asia, Chauffeur Privé in France, and Didi-Chuxing in China (which bought Uber’s China subsidiary in 2016 and soon became the largest on-demand company in the world).

What all these companies share is an asset-light, peer-to-peer model of using individually owned cars. Uber, Lyft, and other TNCs are large companies that don’t own the vehicles they use to provide rides. Most of their product maintenance is around their apps and, as such, they don’t need or have large inventories of vehicles, equipment, or facilities. (They also technically have few employees, because their drivers are contractors — an issue that has now landed their labor practices in controversy.) Their principal innovation was thus not in transportation per se, but in devising computer algorithms that more efficiently matched riders and drivers. The apps removed the exchange of money from the rider-driver relationship — they automatically calculated and billed the fares — and applied some basic economic principles of supply and demand. By raising prices when demand exceeded supply, they resolved the problem of shortages and long wait times that had long plagued conventional taxis. Both Uber and Lyft are now publicly owned companies, but neither business is profitable.

The Fate of Taxis

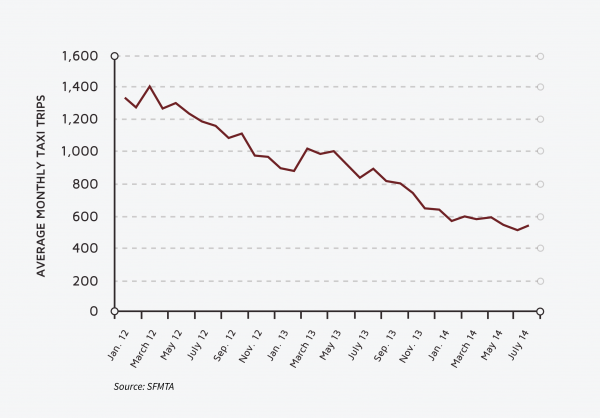

The TNCs brought both opportunities and threats to other shared modes. TNCs may well be an existential threat to the traditional taxi industry. As just one example: Uber launched its UberX product in San Francisco in 2012, the same year Lyft began operating in the city. Between March 2012 and July 2014, the number of taxi rides in San Francisco fell 65 percent and in January 2016, the city’s largest taxi company, Yellow Cab, filed for bankruptcy. From New York to Paris, taxis have been fighting to block Uber and Lyft, sometimes successfully but generally not.

Figure 2. The impact of Uber on taxi ridership in San Francisco

Can taxis adopt some TNC technology to help them compete? Electronic hailing (e-hailing) services, such as Arro, Bandwagon, Curb, Flywheel, Hailo, and iTaxi in the United States, are a step in that direction. Travelers can use these mobile apps — maintained by either the taxi company or a third-party provider — to digitally dispatch a taxi. Although in the works for many years, e-hailing finally emerged largely in response to the success of Uber and Lyft. When taxi companies have adopted it, they have brought their wait times down, closer to those of TNCs. E-hailing alone may not be enough, however. In many jurisdictions, regulations still limit the number of taxis that can operate on the roads and still require taxis to charge locally regulated prices, which means they cannot vary their prices to help balance supply and demand, as TNCs often do.

The Fate of Public Transit

Public transit, like the taxi industry, has struggled in the last decade. Transit’s difficulties are probably linked to a number of factors including low fuel prices (which encourage the use of personal vehicles), poor public transit service in some markets, and competition with shared mobility services like TNCs. The TNC relationship with public transit, however, differs from their relationship with taxis. TNCs are, to taxis, direct competition. While TNCs compete with public transit, they may be able to help it as well.

Public transit operators are under tremendous pressure to improve the quality and quantity of their service, as more cities become focused on improving social equity, urban livability, and air quality, and they want to tackle problems like climate change and traffic congestion. Partnering with shared mobility operators may be one way to help achieve these goals. Public transit often struggles to make first/last-mile connections, provide service in low-density areas or at off-peak times, and provide paratransit service. TNCs, and other shared operators, can help fill these service gaps.

Shared demand-responsive services, in general, can help round out public transportation. Microtransit, for example, provides shuttle-based services that can include fixed or flexible routes, as well as fixed schedule or on-demand services. For riders, these services tend to be less expensive than Lyft, Uber, and taxis, but they are more expensive than public transportation. Typically, riders use mobile apps to pay for trips electronically and track the vehicles as they approach, although a few microtransit services use telephone dispatch and cash payment mechanisms. Microtransit is very similar to another privately operated service called jitneys. The main difference is that jitneys do not use a smartphone for dispatch or payment, and they instead operate in a manner that more closely resembles public transportation. Jitneys can take many forms, and they are common in many cities around the world. In the United States, however, regulators have perceived these services as a threat to public transit, and they have largely disappeared as a result.

One exception is the “dollar vans” of New York City. These vans got their start in 1980, during an 11-day public transit strike. They are a shadow transportation service that follows popular bus routes (thus competing with public transit), but they also serve communities neglected by subways and buses (thus complementing public transit). While jitneys require a license, many unlicensed dollar van vehicles also give rides. These unlicensed operators are technically illegal, but because they are now an integral part of the community, regulators frequently condone them and enforcement has been intermittent. In 2016, dollar vans carried about 120,000 riders per day. In March 2017, 325 official (licensed) dollar vans were in operation, down from more than a thousand just a few years prior. However, this decline probably reflects a lack of license enforcement rather than an actual decline in the number of vehicles.

In recent years, new microtransit services have emerged (e.g., Via). Microtransit could be particularly well-suited to complement, enhance, or replace existing paratransit or dial-a-ride services, which are legislatively required to provide service to passengers with mobility limitations. Paratransit services deploy specially outfitted small buses and vans on request and operate door-to-door. Paratransit became common in the United States in the 1970s as regulators imposed requirements and provided subsidies to serve people with disabilities. Paratransit providers take numerous forms. Some are part of larger transit bus operators; others are small companies that contract with public transit operators and often outsource to taxis. The takeaway is that these services are ripe for integration into a larger shared mobility system and can complement public transit (filling gaps, providing first/last-mile connections, and replacing low-ridership routes).

The Promise of Pooling

As the TNC model has grown, it has also developed specialized niches. Lift Hero provides rides for older adults and those with disabilities, while HopSkipDrive and Kango provide rides for children to and from school.

Among the most transformative services could be those that involve pooling — finding unacquainted riders who have similar origins and destinations and bringing them together in the same vehicle. With pooling services, computer algorithms add riders to vehicles in real-time. In return for the possibility of a slight delay in reaching their destinations, riders typically get a lower fare, even if the driver never picks up another rider.

Pooling is usually associated with Uber and Lyft, but taxis have also experimented with sharing. The idea is the same: multiple passengers with different destinations use the same taxi. Cities like Los Angeles, Burbank (California), and Boston have permitted sharing of taxi rides, although only in downtown districts and at airports. New York City technically allows taxi sharing, but in practice, it has been successful only at airports, some in-city taxi stands, and along one East Side corridor.

Pooling can also be successful for longer intercity trips, as demonstrated by BlaBlaCar, the world’s largest long-distance ridesharing service. BlaBlaCar was founded in France in 2006 as a free platform for carpooling but transitioned in 2011 to a fee-based service. In its current model, it charges users a percentage of trip fees (between 7.9 and 12.5 percent), as well as a fixed amount (about $1) for each trip. It connects drivers and passengers willing to travel together between cities and share the cost of the journey. By 2017, BlaBlaCar had more than 40 million members across 22 countries.

While there are different forms of pooling — carpooling/ridesharing and paid trips (i.e., taxi splitting and TNC pools), the economic sustainability of these business models is important to mention. Traditional carpooling and ridesharing involve incidental trips that would have happened anyway in the driver’s personal vehicle, and the rider may or may not reimburse the driver. A pooled TNC ride, in contrast, involves a commercial transaction with a paid driver. The driver is only making the trip because the riders want to. It is still unclear whether this model can be economically sustainable, particularly without government subsidies.

What makes pooling so important? A study by the Paris-based International Transport Forum in 2016 offers a glimpse into how shared mobility could change urban living. This study, which was a simulation, modeled the impact of replacing all car and bus trips in Lisbon, Portugal, a mid-sized European city, with fleets of shared automated taxis and shuttle buses. Among the key findings: 97 percent fewer vehicles (cars, shuttle buses, and full-size buses) would be needed to serve all trips, 95 percent less space would be required for public parking, and the vehicles would travel 37 percent fewer kilometers. All this would occur because drivers and riders would use each vehicle more intensively: the study estimated that each vehicle would travel 10 times the total distance that current vehicles do. The benefits of pooled fleets include: 1) more efficient use of vehicles (e.g., using a smaller fleet more often rather than a larger fleet of privately owned vehicles, many of which spend most of the day parked); 2) lower cost per passenger (since depreciation and operating costs are spread over many more occupants); and 3) greater vehicle use will result in more rapid vehicle replacement, which could accelerate the adoption of low- and zero-emission fleets (e.g., the California Clean Miles Standard incentivizes the deployment of electric vehicles in TNC fleets).

A second study, also a simulation, by researchers at the Lawrence Berkeley National Laboratory, found that a fleet of shared, automated, electric vehicles, when combined with a low-carbon electricity grid (forecasted for 2030), could reduce per-mile GHG emissions by 63 to 82 percent by 2030 compared to privately owned hybrid vehicles.

These studies suggest that pooling, especially when combined with other interventions, may offer numerous transportation, infrastructure, environmental, and social benefits. Pooled rides have a far smaller carbon footprint, consume much less road space and parking space, and have the potential to serve far more trips. In short, pooling is critical to maximizing the benefits of shared mobility. Innovative one-way and peer-to-peer carsharing represents a critical first step toward creating more choice for travelers and making it easier for drivers to give up personal car ownership.

Studies suggest that pooling, especially when combined with other interventions, may offer numerous transportation, infrastructure, environmental, and social benefits.

When Do People Choose Shared Rides?

App-based pooling has promise, but its future is unclear. The technology is largely in place: Advancements in technology and mobile computing, along with widespread use of smartphone apps and tracking technologies, provide new opportunities for pooling. Some big questions are behavioral: when, and under what conditions, are people willing to give up personal car space and at what price are people willing to share rides with strangers? This question is particularly salient now, given the COVID-19 pandemic and heightened sensitivity about social distancing, but will be highly relevant even when the health emergency ends.

Other questions are financial: Uber and Lyft still haven’t reached profitability. What is the path to firms making money selling shared rides? Pooling can help, since it lowers costs for firms while adding more riders, but whether firms can attract enough shared rides to be profitable remains to be seen.

Public policy will play an influential role in accelerating pooling in conventional, electric, and eventually automated vehicles. Cities will need to make pooling more attractive, perhaps by giving priority to pooled vehicles at curbs and on roadways.

People and cities are on the cusp of rapid change as advancements in technology and services converge in the marketplace. The need to reduce congestion and emissions globally, coupled with the overarching trends of population growth and urbanization, is contributing to a fundamental reimagining of transportation across the world. The convergence of shared mobility services, with other technologies, including fleet electrification and vehicle automation, could lead to fundamental changes and disruption in how people live, work, shop, and travel every day. Cities will need to experiment to find the right mix of policies. What is certain is that we are entering a new era of mobility unlike anything we have seen since the introduction of the automobile more than a century ago.