Can charging-as-a-service expand EV adoption in California?

Transportation is the largest contributor to greenhouse gas emissions in the United States, accounting for about half of emissions in California. To address this, the state of California has set aggressive targets for reducing greenhouse gas emissions, including a nearly 37-fold increase in zero-emission vehicles on its roads by 2045.

Achieving these goals requires ambitious zero-emission vehicle rules and clean energy infrastructure programs. It also necessitates the expansion of reliable and low-cost charging infrastructure to boost consumer confidence in EVs.

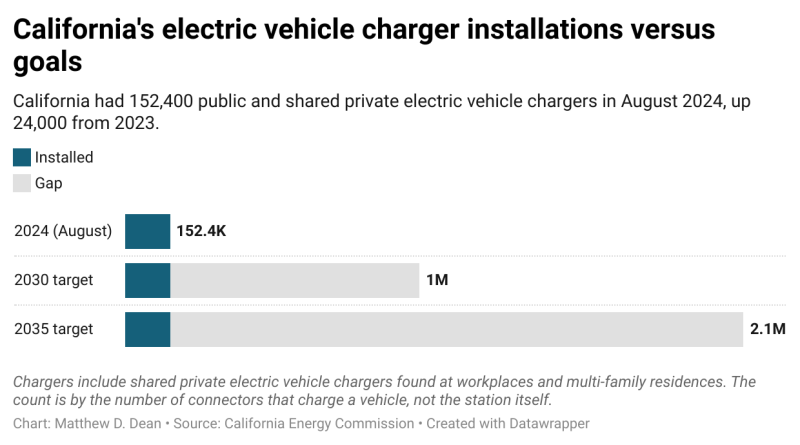

However, California’s goal of installing 1 million public chargers by the end of 2030 requires a significant acceleration of efforts. The state needs to install chargers at seven times the current pace to meet this target. To further complicate things, several obstacles stand in the way of closing this gap — and the charging-as-a-service (CaaS) model may be the solution.

Obstacles to EV charger expansion

Research has identified several roadblocks to installing more chargers, including delays in accessing the power grid, permitting delays, funding uncertainty, and challenges with local codes. The process of planning, constructing, and maintaining charging infrastructure is complex, often involving multiple stakeholders such as electric utilities, property owners, tenants, charging network providers, equipment hardware and software vendors, and general contractors.

While California has launched grant funding streams to support EV charging adoption in low-income communities, the cost of purchasing and installing chargers can still be prohibitive. Prices can quickly approach $6,000 in easy-to-install locations for Level 2 chargers, which add about 25 miles per hour of charging using a 240-volt electrical outlet (i.e., the same outlet an electric stove uses), and exceed $100,000 for fast-charging equipment. While fast chargers may be present in everyday public locations, such as shopping malls, they are most often used for long-distance trips.

The charging-as-a-service solution

CaaS is a new business model that could help address these challenges. Under this model, customers pay a monthly subscription fee rather than making an upfront investment in charging infrastructure. The CaaS provider assumes responsibility for procuring, installing, maintaining, and replacing charging equipment on behalf of the customer.

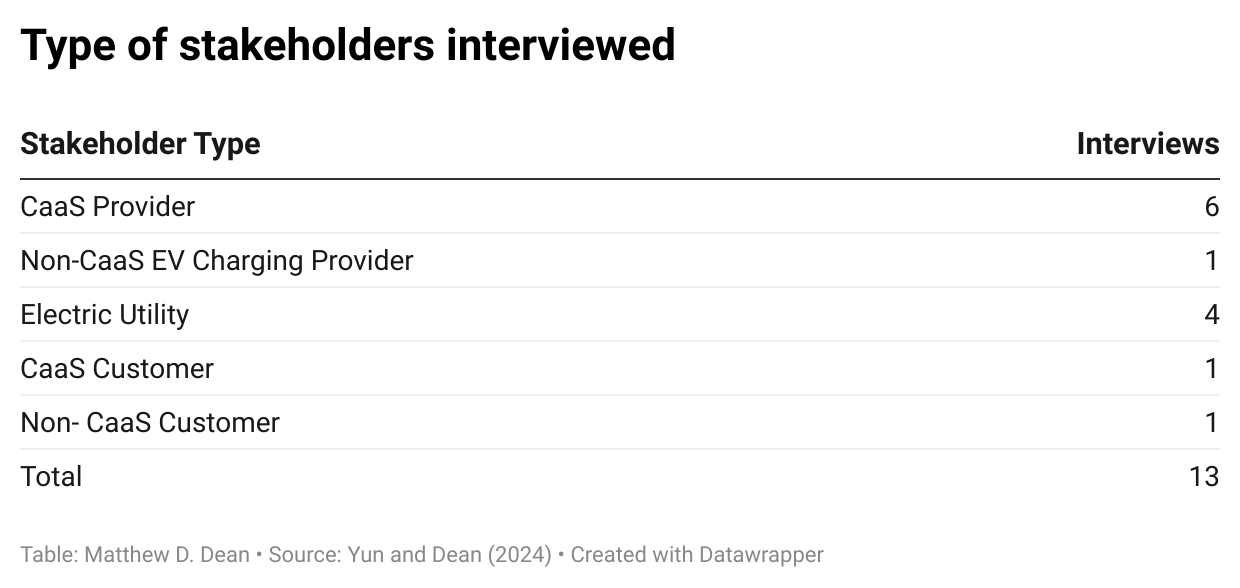

We recently conducted semi-structured interviews with 13 stakeholders, primarily CaaS providers and electric utilities, to identify the perceptions, challenges, and opportunities of the CaaS business model in addressing California’s charging station needs.

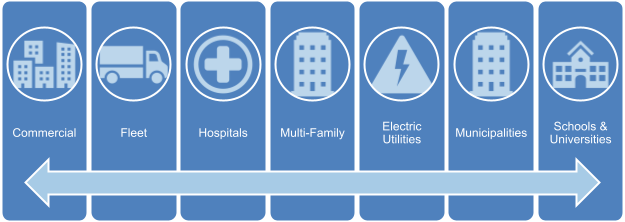

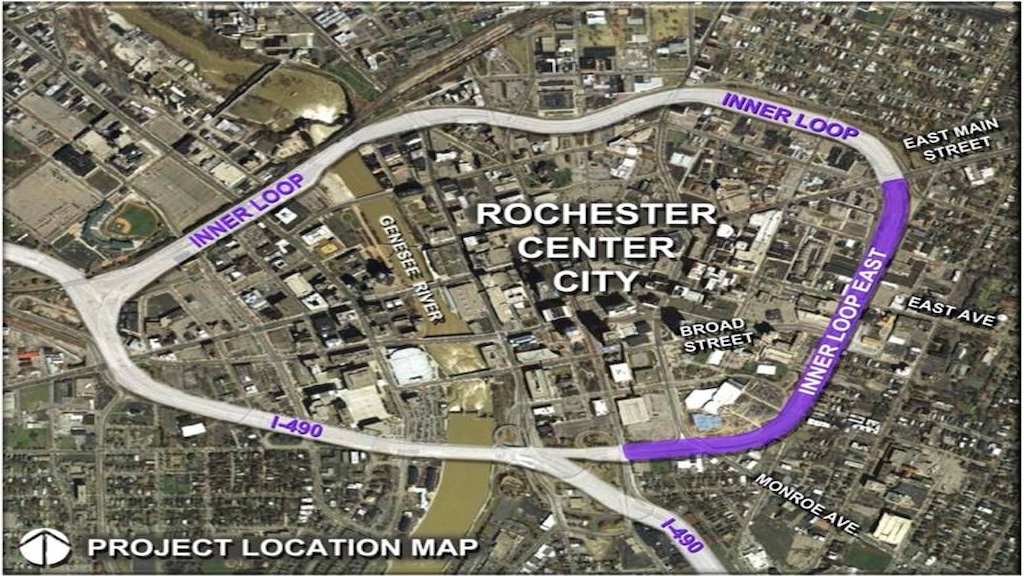

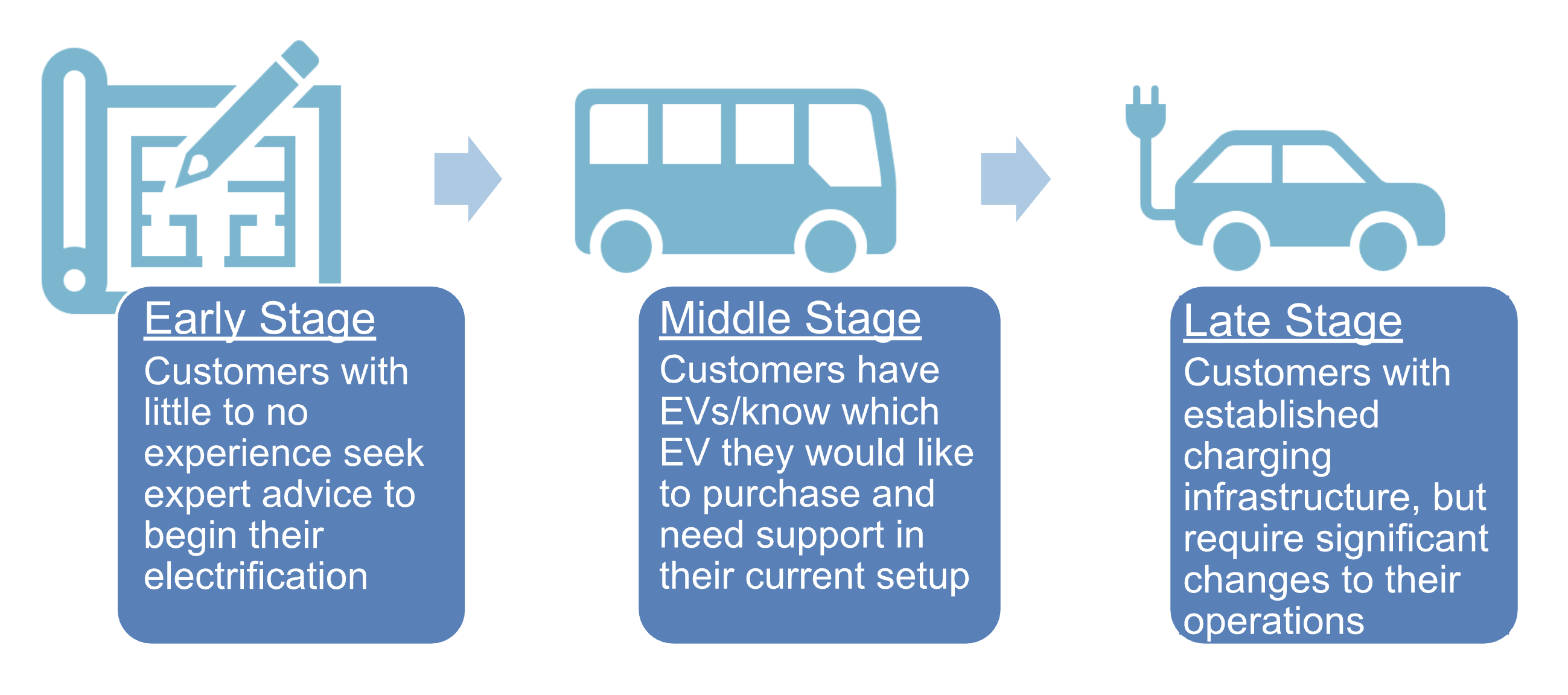

The study found that CaaS providers serve a wide variety of customers — ranging from residential to commercial — at different stages of electrification, from those just starting to those upgrading their current EV charging operations.

Types of clients and the stages when they seek CaaS electric vehicle (EV) charging infrastructure services. Yun and Dean, CC BY-NC

For new customers, transitioning to EVs can be daunting. One CaaS provider noted:

“Most everybody is saying we don’t know what to do. You know, we have some ideas. And it’s kind of the Wild, Wild West because they’re in, they’re looking for you know what options should we take, and there’s a lot now.” — CaaS Provider 02

CaaS providers guide clients through electrification options and assist them in making informed decisions about their charging infrastructure. Whether clients have initiated their electrification transition by purchasing EVs or are in the planning phase where they need assistance on charging or what they plan to buy, CaaS providers say they can offer flexible solutions.

On the other end of the spectrum, CaaS solutions can meet the needs of customers that are further along in the electrification process:

“So, I have customers who have built a few chargers and own trucks in their own yard, understand that challenge, or maybe have used up all their power. And now, as they expand their fleet, want to use our [depot] facilities.” — CaaS Provider 07

Benefits of the CaaS model

Charger unreliability is one of the key contributors to well-documented range anxiety and why many are hesitant to make the switch to all-electric. EV charger reliability is also a major concern in the stand-alone charging industry (e.g., Electrify America, ChargePoint), typically funded by venture capital, shareholders, and large amounts of public grant funding. With this in mind, we identified three key ways in which the CaaS business model could benefit California’s goal of expanding access to charging infrastructure:

1. CaaS providers seek long-term relationships with clients, which also increases the longevity of charging infrastructure.

Long-term contracts are essential to CaaS providers because it allows them to make a return on their large upfront investment in charging infrastructure. CaaS providers may be more capable of guaranteeing reliable chargers because they have the dedicated workforce and resources to maintain equipment. CaaS providers are also incentivized to maintain their chargers because their subscription fees cover infrastructure and maintenance costs. To make a profit and grow this business model, CaaS providers must prove their model delivers a smooth charging experience to their customers for the duration of their contract.

2. CaaS providers are dedicated experts who manage charging infrastructure projects and fill the knowledge gaps of charging customers.

Individuals and organizations quickly learned through experience that charging infrastructure is most successful with expert knowledge and a dedicated team to manage charging plans and projects. CaaS providers assess and help curate charging solutions for their customers who are unfamiliar with power capacity limits and the charging options available to them. Small and lower-income jurisdictions and public utilities may not have a dedicated electrification team or resources to undertake charging projects themselves and can outsource charging to these providers.

CaaS providers explained in interviews that policymakers would benefit from talking with and working with them on charging infrastructure calls for proposals and regulations. For example, requiring a large number of installed chargers before the demand for them can have unintended consequences for all parties involved. EV charging equipment, like any other type of connected equipment, may become obsolete or worn-down if demand is not met effectively:

“Okay, maybe 6–7 chargers will fulfill the target needs of these 25 vehicles. Then, the next year the population is not 25 but 40. Well, then you add 3–4 more chargers in the same row to fulfill the needs of a new, bigger community of 40. But deploy like 50 chargers in one location on day one—it is a waste of resources. It will be comparable to purchasing today a pile of 50 laptop computers for the employees that you are planning to hire 5 years from now. So, in 5 years when you hire that new employee, guess what? That laptop is already old. And has been collecting dust in the corner, nobody is using that. And then you get a new employee with an old laptop, right? You don’t need that to happen.” — CaaS Provider 04

3. CaaS solutions are flexible and well-positioned to scale EV charging infrastructure.

CaaS providers have adjusted their solutions to meet their clients’ affordability and scaling needs. They adapt their charging solutions based on industry realities, such as electric grid constraints and supply chain delays. With power capacity limitations, CaaS providers have developed managed charging technology and built relationships with electric utilities to plan and scale charging infrastructure:

“What we found is that often we go to someone like PG&E and say we need 3 megawatts at, you know, this corner in downtown [city] and they’ll say we can give you a megawatt in 12 months or in 6 months, but it’ll take us three years to give you 3 megawatts or two-and-a-half years. And so, what we’ll tend to want to then do is still build to the capacity, but run the whole station at a lower overall impact on the grid. And really interestingly in some of those locations, what we found, is that somebody like PG&E will come back and say, oh, actually you’re constrained to a megawatt during these hours of the day but actually the rest of the hours of the day, you could go to full 3 [megawatts]. Because we don’t have an issue, but during these hours in a day, you must constrain.” — CaaS Provider 03

Challenges in the charging industry

Despite its benefits, the CaaS model is not without challenges. The third-party charging industry is still emerging, and some CaaS companies have faced organizational instability, impacting customer experiences. Customers of CaaS providers described in interviews that they experienced less than ideal services because of mergers and acquisitions as well as bankruptcies:

“There’s several companies that went bankrupt. The company that I liked, that did all the back-end monitoring for me, sold their company and merged which [EV Charging Company], and I feel like [EV Charging Company], has made it their mission to make every charger fail every day. They are not very helpful and they’re very expensive. If I have to call someone else to fix one charger, it’s around $2,000 every unit.” — Electric Utility 01

“There’s been challenges, as with any kind of company in growth mode. There’s been a lot of employee turnover. Some of the people we used to be able to know in the organization were senior. We kind of get passed around a bit from person to person. They’ve been restructuring. Reorganizing probably every year for the last eight years. So, your dedicated account manager, this person’s going to be also your account manager for these assets. So we do try and keep everything [with one CaaS employee] … So, we don’t want just [any] person. We want that one-stop shop, so [the challenges have] mostly been around organizational challenges.” —EV Charging Customer 01

Customers who opt for an unbundled service, which provides access to a CaaS charging network without ongoing maintenance, may need to carefully consider if this model meets their needs.

Image: Inderpreet via Pixahive.com